Under the current structure, buyers have separate representation and cover the cost of that representation through something called "cooperative compensation". In other words, the seller's agent shares their commission with a buyer's agent via escrow. This effectively allows buyers to finance their agent's commission rather than paying an additional fee on top of everything else, meaning less money out of a homebuyer's pocket upfront. Currently, seller's agents publicize the amount of that commission in their local Multiple Listing Services (MLS); typically 2.5% - 3% of the home's sales price. Under the proposed structure, home sellers may opt to lower the amount they pay their agent, thereby eliminating "cooperative compensation" altogether. Without the ability to publicly display how much, if anything at all, would be shared with the buyer's agent, buyers will work out an agreement to pay their agent upfront. Pros & cons of the NAR changes

The big question ... will a change in commission structure lower house prices?

The answer ... frustratingly, yes and no. Yes, the change in commission will lower house prices, because buyers' budgets now have to account for their agent's fees, thereby reducing the total amount they can afford upfront. BUT, as long as home supply remains low and demand high (surplus of Silicon Valley high wage earners) home prices will undoubtedly continue to rise. My hunch is properties will still sell quickly, with multiple offers, over list price. The only difference will be that the competition pool of those who can actually afford super high properties will get slightly smaller.

0 Comments

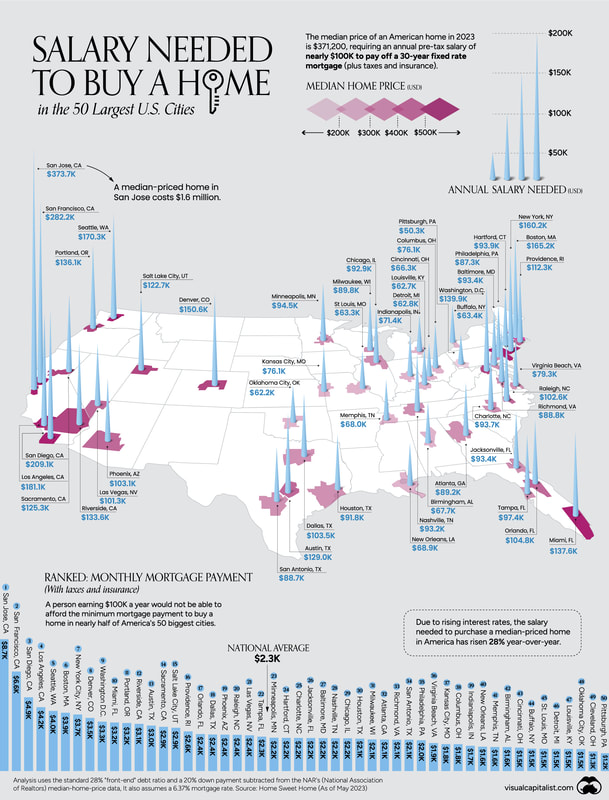

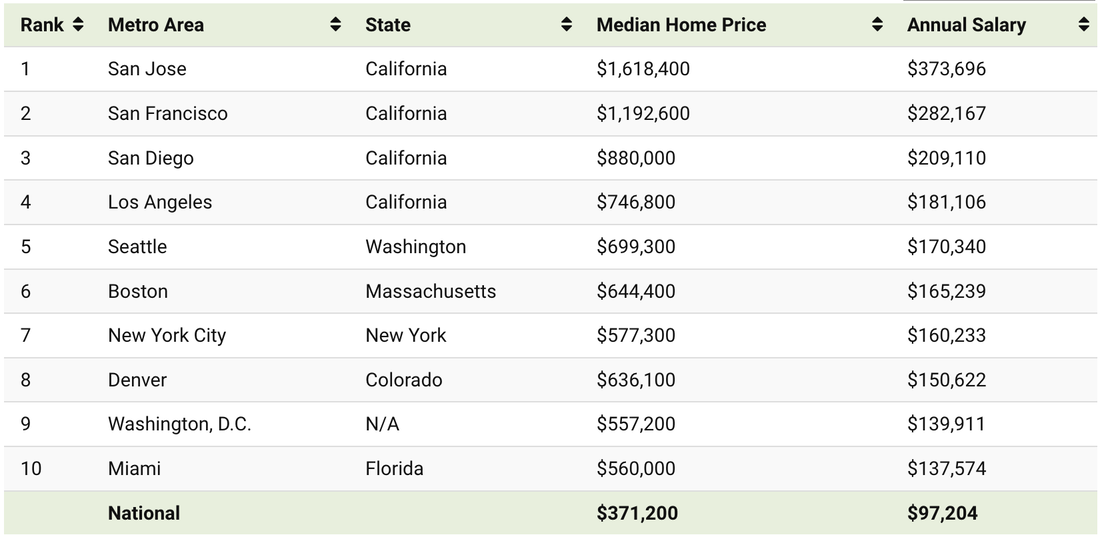

Ever wondered how much money you need to make to buy a home in San Jose? A recently published article by Visual Capitalist provided a map showing how much you need to earn in 50 American cities. They used May 2023 data tabulated by Home Sweet Home to map out the annual salary needed to afford a 30-year mortgage (at a 6.37% interest rate) in America’s 50 most populous metropolitan areas. Topping the list as the most unattainable city for the average American is SAN JOSE, CA! To own a home in our very own backyard, they estimate one would need to earn a staggering minimum of $374,000 annually to afford a $1.6 million home. To put this in perspective, the median annual income for the average American is $75,000, which is a mere one-fifth of what is required to make homeownership in San Jose a reality. The following list ranks the annual earnings needed to secure a home in the top 10 most expensive cities, from the least to the most affordable. See original article: What You Need to Earn to Own a Home in 50 American Cities

The holiday season is one of the busiest and most joyous times of the year, so it's hard to imagine tacking on another "to-do" ... let alone a major one such as buying or selling a home. While it might not seem like a good time to take on such a monumental project -- there are benefits for both sides. Whether you're a buyer or a seller, check out the top 3 benefits of a holiday home sale. IF YOU'RE A SELLER 1) Motivated Buyers Who wants to spend their free time and holiday vacation touring homes? Serious buyers, that's who. While open house attendance and home tour requests might be lower than the (usually busy) Spring/Summer season, the number of truly motivated buyers will be higher — think quality over quantity. Anyone shopping for a new home between Thanksgiving and the New Year is likely to be a serious buyer — and your house may be exactly what they’re searching for! If you work with an agent to list your house this winter, you’ll be able to get in front of the buyers who are ready to purchase now, in the hopes of making a move before the year ends.  2) Less Competition Homeowners are typically less likely to list their houses toward the end of the year — and understandably so. We're all busier around the holidays and the majority of people who are thinking of selling their home choose to wait until after the new year when their social calendars are less inundated. As a result, there won't be an endless supply of properties so there's more time for serious buyers to focus on your home. Added bonus: the limited number of available homes means you may be able to command a higher asking price for your property.  3) More Time for Touring Homes It’s not just less competition that’s in sellers’ favor during the holidays. As busy as the holidays can get, there's also an increased amount of free time as usual commitments are placed on hold and people tend to have more time off from work/school than at any other time of the year. This creates a pool of buyers who may be ready to see your home at a moment’s notice. What's more, most neighborhoods are delightfully decorated and there's an aura of holiday cheer, making buyers feel cozier in your home.

IF YOU'RE A BUYER 1) Less competition With the market as hot as it’s been, buyers have been forced to act fast. If you're a seasoned buyer you may have felt defeated by the spring/summer bidding wars. Typically, the fervor of multiple buyers and over-list price offers slow down come winter, so the holidays could be your season to buy! In the Silicon Valley, home buying activity remains strong thanks to low inventory and (before the most recent rate hikes) low interest rates. That being said, home buying traffic tends to dip around the holidays, which means less competition and a chance your first offer will be accepted.  2) Potential for Negotiation Fewer buyers per home reduces a seller's upper hand making it a more balanced negotiation process. Sellers may be more willing to negotiate price, contract terms, and closing date, especially if your offer is the only one around. Home prices tend to be lower around the holidays and then you couple that with threats of a recession and we're seeing sellers offer unprecedented buyer credits and interest rate buy-down options, making it more affordable than ever to be a home buyer.  3) End of Tear Tax Breaks Yet another boon for buyers: end-of-year home purchases, even at the very end of the year, the chance to squeeze in an important tax write-off. Homeowners can deduct some of the closing costs associated with the purchase of a new home in addition to their mortgage interest on primary residences up to $750,000, along with combined deductions for up to $10,000 of local, state, and property taxes. Other homeowner-friendly deductions, like moving expenses in some states, may also apply.

|

Archives

March 2024

Categories |

RSS Feed

RSS Feed