Under the current structure, buyers have separate representation and cover the cost of that representation through something called "cooperative compensation". In other words, the seller's agent shares their commission with a buyer's agent via escrow. This effectively allows buyers to finance their agent's commission rather than paying an additional fee on top of everything else, meaning less money out of a homebuyer's pocket upfront. Currently, seller's agents publicize the amount of that commission in their local Multiple Listing Services (MLS); typically 2.5% - 3% of the home's sales price. Under the proposed structure, home sellers may opt to lower the amount they pay their agent, thereby eliminating "cooperative compensation" altogether. Without the ability to publicly display how much, if anything at all, would be shared with the buyer's agent, buyers will work out an agreement to pay their agent upfront. Pros & cons of the NAR changes

The big question ... will a change in commission structure lower house prices?

The answer ... frustratingly, yes and no. Yes, the change in commission will lower house prices, because buyers' budgets now have to account for their agent's fees, thereby reducing the total amount they can afford upfront. BUT, as long as home supply remains low and demand high (surplus of Silicon Valley high wage earners) home prices will undoubtedly continue to rise. My hunch is properties will still sell quickly, with multiple offers, over list price. The only difference will be that the competition pool of those who can actually afford super high properties will get slightly smaller.

0 Comments

Buying a home, especially for the first time, can feel like a daunting task. There are many things you need to do before you can confidently make an offer on a home, especially in a fast-paced environment like the Silicon Valley. Once your offer has been accepted you'll likely be excitedly counting down the days until you can move in and start your life as a homeowner. So even if you've been pre-approved for a home loan avoid these financial mistakes during the home buying process. Here are the top 5 financial mistakes you'll want to keep in mind.

4. Don't consolidate debt It may seem like a positive thing to consolidate debt and it's true that over time debt consolidation can help making it easier to make payments on time which will improve your credit score and reduce your overall debt, however, debt consolidation can have a detrimental impact on your credit score. This is because taking out a new loan and closing multiple accounts in a short period of time appears risky to credit reporting bureaus as well as a mortgage lender's underwriter, the person responsible for thoroughly analyzing your finances.

San Jose, California, often referred to as the heart of Silicon Valley, is a city that boasts a unique blend of tech innovation, cultural diversity, and a thriving lifestyle. As someone who has had the pleasure of living in this vibrant city, I can attest to the fact that San Jose offers a little something for everyone.

Cultural diversity: San Jose's rich cultural tapestry is a significant highlight. The city is a melting pot of cultures, with a diverse population that contributes to a vibrant and inclusive community. You'll find a wide array of international cuisines, cultural events, and festivals throughout the year, providing an opportunity to explore and appreciate different traditions. Outdoor activities: If you're an outdoor enthusiast, you'll love San Jose's climate. The city boasts nearly 300 sunny days a year, making it perfect for those who enjoy hiking, biking, or simply soaking up the sun. Nearby, you'll find picturesque parks, including Alum Rock Park and the Santa Cruz Mountains, where you can escape the city's hustle and bustle and connect with nature.

Museums & attractions: The city is home to a number of cultural attractions, including the San Jose Museum of Art, the Tech Interactive, and the Rosicrucian Egyptian Museum. Whether you're interested in art, science, or history, there's something to inspire and educate everyone. There are a plethora of parks scattered throughout San Jose as well, making it a suburban sanctuary for families, with a kid-friendly area to play in almost every sub-neighborhood. Education and innovation: San Jose is also known for its exceptional educational institutions. San Jose State University, along with the many nearby colleges and universities, attracts students from all over the world who come to study and be part of the region's dynamic innovation ecosystem.

Easy access to the rest of the Bay Area:

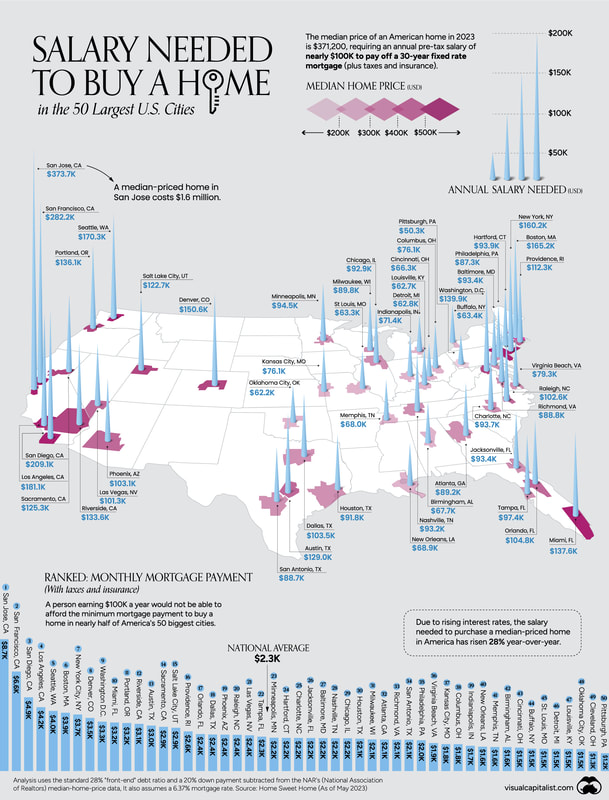

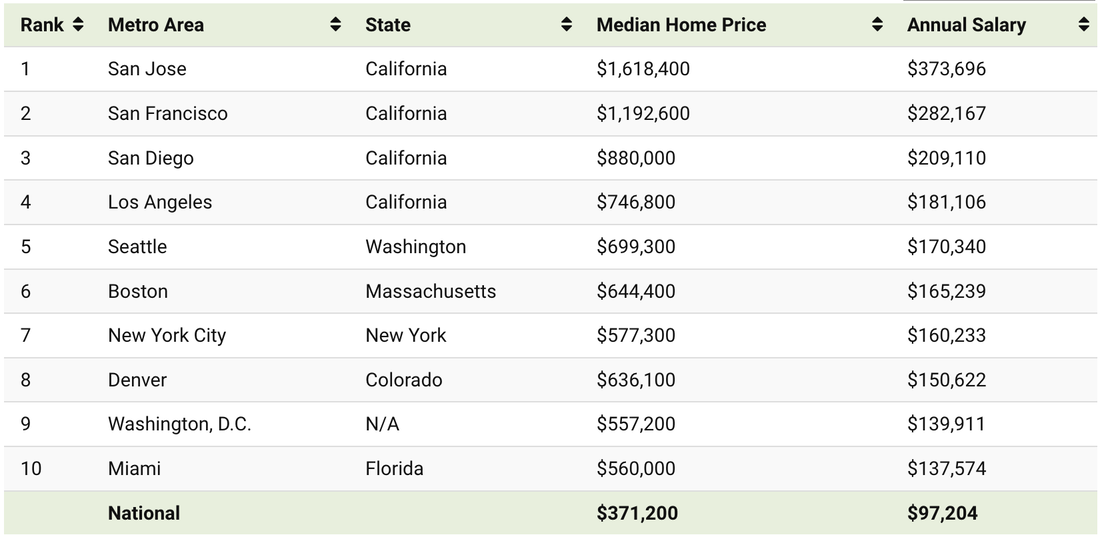

Living in San Jose also means you're a stone's throw away from the iconic attractions of the Bay Area such as San Francisco, Napa Valley, the stunning coastline from Santa Cruz to Half Moon Bay, and the dense redwood forest of the Santa Cruz mountains. Are all within reach, making weekend getaways and day trips a breeze. Cost of living: All this prosperity comes with a significant cost of living. San Jose consistently ranks as one of the most expensive places to reside in the United States. Housing costs, in particular, are exceptionally high, that are barely affordable for local incomes. Additionally, the overall cost of living, including transportation, groceries, and entertainment, can be significantly above the national average. While San Jose offers a wealth of opportunities and a high quality of life, potential residents should be prepared for the financial stretch that comes with the city's allure. In conclusion, living in San Jose, California, is an experience like no other. With its technological prowess, cultural diversity, outdoor activities, and a genuine sense of community, this city offers an alluring mix of opportunities and a high quality of life. If you're looking for a place that's at the forefront of innovation while embracing the beauty of everyday living, San Jose is undoubtedly a city worth considering. Ever wondered how much money you need to make to buy a home in San Jose? A recently published article by Visual Capitalist provided a map showing how much you need to earn in 50 American cities. They used May 2023 data tabulated by Home Sweet Home to map out the annual salary needed to afford a 30-year mortgage (at a 6.37% interest rate) in America’s 50 most populous metropolitan areas. Topping the list as the most unattainable city for the average American is SAN JOSE, CA! To own a home in our very own backyard, they estimate one would need to earn a staggering minimum of $374,000 annually to afford a $1.6 million home. To put this in perspective, the median annual income for the average American is $75,000, which is a mere one-fifth of what is required to make homeownership in San Jose a reality. The following list ranks the annual earnings needed to secure a home in the top 10 most expensive cities, from the least to the most affordable. See original article: What You Need to Earn to Own a Home in 50 American Cities

When housing prices are at an all time high, it may seem like it's because sellers are greedy and unwilling to lower their price. Sure, if you're a seller you want to get top dollar for your home, but its not greediness at play -- it's economics 101: supply and demand. The Silicon Valley housing market has been grappling with a shortage of available homes for years, resulting in a highly competitive environment for homebuyers. The imbalance between housing supply and demand has been a significant driver behind skyrocketing prices and an increasingly unaffordable market - even when interest rates were at an all time low. 3 reasons why

In a nutshell, here are the top 10 things that should be on your homebuyer inspection checklist: 1. Roof condition: Check for any signs of damage, leaks, or missing shingles. 2. Electrical system: Test all outlets and switches, and check for any exposed wiring. 3. Plumbing system: Inspect all pipes and fixtures for any signs of damage or leaks. 4. HVAC system: Test all air conditioning and heating units for proper operation. 5. Foundation: Look for any signs of cracking or shifting that could indicate structural damage. 6. Windows and doors: Check for proper operation and any signs of damage. 7. Exterior walls: Check for any signs of water damage or other structural issues. 8. Interior walls: Check for any signs of water damage, mold, or other structural issues. 9. Floors: Check for any signs of damage or unevenness. 10. Attic/Crawlspace: Check for any signs of water damage, mold, or other structural issues. Want a one page print out, with check boxes and all? Click here: HOME INSPECTION CHECKLIST Otherwise, read on for more details on what you/your home inspector is looking for and why. Look for issuesBuying a new home is one of the most exciting events in your life. It's also probably the biggest financial commitment you'll ever make. The home inspection checklist is a must for all buyers. Some people skip this step to save time or money. However, it'll benefit you in the long run to stop problems from the outset rather than pay for repairs down the road. Plumbing & HVAC Plumbing and HVAC systems are critical to your home and to your comfort. Well-built plumbing components and a high functioning heating and air conditioning system will keep you and your family members happy for years to come. As your home inspector begins the process, you can ask permission to stand by as they conduct the inspection. They'll be keeping an eye out for leaky, rusted, or broken pipes. They should also go into every room in the house and stand near the vents. Do you feel steady airflow? If you don't, there's a problem somewhere in the vents or with the heating or cooling (HVAC) unit. It's important to pay attention to unusual smells such as gas. A home inspector will also test the water temp and pressure- the temperature should not exceed 125 degrees Fahrenheit. Watch the foundation Your mind will be at ease if you know the foundation is strong and sure. The home inspection checklist is not complete until the foundation has been investigated. The inspector should examine it for cracks or any shifting at the base of the walls and ceiling. Look for standing water or other moisture under the home (if it's a single family house or townhome on a raised foundation). The drainage system should also carry water properly away from the home. Check the roof A good roof should last at least 20 years, and some do their jobs for up to 50. Still, don't neglect this part of the home inspection checklist. The home inspector will examine the roof for evidence of missing shingles, leaks or weak spots. Large areas of patching will also be a red flag, and can be discussed further to assess whether repair(s) or a full replacement is recomended. Eye the electrical  The inspector should spend some time looking at the wiring in the house. The circuit box should also be in good condition and be able to handle sufficient electrical loads. You must not see any exposed wires or splices. Final thoughtsKeep in mind that these are "typical" areas of focus for most residential home inspectors. Special properties, such as condos, or homes that are built on land requiring a well for water and a septic system for waste removal, can require specialty inspections. It's important to work with a Realtor who has great connections with a variety of inspectors to keep you ... and the largest purchase of your life ... safe.

First of all, it goes without saying that no one has a crystal ball nor the ability to truly predict what's going to happen within the Silicon Valley real estate market in 2023 – BUT – we're always looking at data and metrics and other indicators .. from the federal government .. to local trends, to get a sense of what the market might do. With that in mind, here are a few pros and cons of buying a condo/townhouse/single family house this year: Why 2023 is a GOOD time to buy a home By now, the economy has mostly recovered from the economic downturn caused by the COVID-19 pandemic, and though there will be lingering effects of the disruption, buying, selling, and open houses are back to normal. In 2023, the wildcard will be interest rates. As many people shopping for homes know, interest rates shot up in 2022 from 2.5/3 percent to the 6/7 percent range. It looks like we've seen the top and already this year rates have started to decline, so jumping into the buyer pool now means you may be able to snag a home with less competition while other buyers hang out on the sidelines waiting for interest rates to go down further. Yes, your monthly mortgage will go up due to interest rates being higher than the historical lows we saw the past few years, but it's incredibly unlikely we'll see those rates again anytime soon (barring an economic crash); and if/when interest rates do go down, you can always refinance to get a lower interest rate. In the long run, you end up spending about the same amount, because in the Silicon Valley real estate market, bidding wars cause buyers to spend more than they'd like in order to "win" against the competition. So, fewer buyers to compete against balances out higher interest rates. Furthermore, once the threat of recession goes away it's back to business as usual and you could be sitting comfortably in your own (albeit expensive) home while prices continue to rise. Why 2023 is a BAD time to buy a home Although Silicon Valley home sales from Nov, 2022 - Jan 2023 have dropped significantly, we don't expect things to stay that way for long. As much as I'd love to see a balanced market, the challenge our area continues to face is a lack of inventory. There's simply not enough (affordable) homes for sale. It is likely that home prices will be higher in 2023 than they were in 2021/22. Additionally, mortgage interest rates could be higher as well, which would lead to higher monthly payments. The main concerns regarding the purchase of a home in 2023 is simply the economy at large – the usually insulated Silicon Valley tech world has begun to see layoffs for the first time in a decade and the stock market has continued its roller coaster ride alongside inflation and whispers of the r-word ... recession. If your income source or overall life plan doesn't give you the confidence of at least 2 years of stability, then buying a home in 2023 may not be the right move for you. What are the 2023 real estate predictions? 1. More buyer competition: As the economy continues to improve, more buyers will enter the market, driving up competition and prices.

2. Home prices will continue to rise: Low inventory, high demand, and rising costs of materials and labor will fuel further appreciation in home prices. 3. Interest rates will stabilize: The Federal Reserve is expected to keep interest rates lower than the highs of 2022, which will support home purchases. 4. Mortgage lending standards will remain tight: Banks and lenders will remain cautious and only lend to qualified borrowers. 5. More alternative financing options: With more people struggling to qualify for traditional loans, alternative financing options such as rent-to-own and lease-to-own could become more popular in less demand metros. 6. More people will embrace remote working: The pandemic has ushered in a new era of remote working, allowing people to live and work anywhere. This will lead to a continuation of people moving to more affordable and rural areas. 7. More demand for green and energy-efficient homes: Demand for green and energy-efficient homes is expected to increase as people become more conscious of their carbon footprint. 8. More demand for income-producing rentals: A result of people looking for flexible living arrangements and income-generating opportunities. The holiday season is one of the busiest and most joyous times of the year, so it's hard to imagine tacking on another "to-do" ... let alone a major one such as buying or selling a home. While it might not seem like a good time to take on such a monumental project -- there are benefits for both sides. Whether you're a buyer or a seller, check out the top 3 benefits of a holiday home sale. IF YOU'RE A SELLER 1) Motivated Buyers Who wants to spend their free time and holiday vacation touring homes? Serious buyers, that's who. While open house attendance and home tour requests might be lower than the (usually busy) Spring/Summer season, the number of truly motivated buyers will be higher — think quality over quantity. Anyone shopping for a new home between Thanksgiving and the New Year is likely to be a serious buyer — and your house may be exactly what they’re searching for! If you work with an agent to list your house this winter, you’ll be able to get in front of the buyers who are ready to purchase now, in the hopes of making a move before the year ends.  2) Less Competition Homeowners are typically less likely to list their houses toward the end of the year — and understandably so. We're all busier around the holidays and the majority of people who are thinking of selling their home choose to wait until after the new year when their social calendars are less inundated. As a result, there won't be an endless supply of properties so there's more time for serious buyers to focus on your home. Added bonus: the limited number of available homes means you may be able to command a higher asking price for your property.  3) More Time for Touring Homes It’s not just less competition that’s in sellers’ favor during the holidays. As busy as the holidays can get, there's also an increased amount of free time as usual commitments are placed on hold and people tend to have more time off from work/school than at any other time of the year. This creates a pool of buyers who may be ready to see your home at a moment’s notice. What's more, most neighborhoods are delightfully decorated and there's an aura of holiday cheer, making buyers feel cozier in your home.

IF YOU'RE A BUYER 1) Less competition With the market as hot as it’s been, buyers have been forced to act fast. If you're a seasoned buyer you may have felt defeated by the spring/summer bidding wars. Typically, the fervor of multiple buyers and over-list price offers slow down come winter, so the holidays could be your season to buy! In the Silicon Valley, home buying activity remains strong thanks to low inventory and (before the most recent rate hikes) low interest rates. That being said, home buying traffic tends to dip around the holidays, which means less competition and a chance your first offer will be accepted.  2) Potential for Negotiation Fewer buyers per home reduces a seller's upper hand making it a more balanced negotiation process. Sellers may be more willing to negotiate price, contract terms, and closing date, especially if your offer is the only one around. Home prices tend to be lower around the holidays and then you couple that with threats of a recession and we're seeing sellers offer unprecedented buyer credits and interest rate buy-down options, making it more affordable than ever to be a home buyer.  3) End of Tear Tax Breaks Yet another boon for buyers: end-of-year home purchases, even at the very end of the year, the chance to squeeze in an important tax write-off. Homeowners can deduct some of the closing costs associated with the purchase of a new home in addition to their mortgage interest on primary residences up to $750,000, along with combined deductions for up to $10,000 of local, state, and property taxes. Other homeowner-friendly deductions, like moving expenses in some states, may also apply.

|

Archives

November 2023

Categories |

RSS Feed

RSS Feed